Clark Wealth Partners Can Be Fun For Everyone

Rumored Buzz on Clark Wealth Partners

Table of ContentsAll About Clark Wealth PartnersClark Wealth Partners Things To Know Before You Get ThisThe Only Guide for Clark Wealth PartnersAbout Clark Wealth Partners4 Simple Techniques For Clark Wealth Partners

Put simply, Financial Advisors can tackle component of the obligation of rowing the boat that is your economic future. A Financial Expert should deal with you, except you. In doing so, they should serve as a Fiduciary by putting the most effective passions of their customers above their own and acting in great belief while giving all pertinent realities and avoiding conflicts of interest.Not all connections are effective ones. Potential downsides of functioning with a Monetary Expert consist of costs/fees, high quality, and prospective desertion.

Absolutely, the objective ought to be to seem like the guidance and solution obtained are worth greater than the expenses of the partnership. If this is not the instance, after that it is a negative and thus time to reevaluate the connection. Cons: Top Quality Not all Monetary Advisors are equal. Equally as, not one expert is best for every possible customer.

Some Known Details About Clark Wealth Partners

A customer should constantly be able to address "what happens if something occurs to my Financial Expert?". It starts with due diligence. Constantly correctly veterinarian any Financial Consultant you are pondering collaborating with. Do not count on ads, honors, credentials, and/or references solely when seeking a connection. These methods can be used to narrow down the swimming pool no question, but then gloves need to be placed on for the remainder of the job.

when talking to experts. If a details area of experience is required, such as functioning with exec compensation strategies or establishing up retirement for small company proprietors, find advisors to interview who have experience in those fields. Once a relationship starts, stay spent in the partnership. Dealing with a Financial Advisor ought to be a partnership - Clark Wealth Partners.

It is this kind of initiative, both at the beginning and with the connection, which will help emphasize the advantages and hopefully decrease the negative aspects. Do not hesitate to "swipe left" several time prior to you finally "swipe right" and make a strong link. There will be a price. The role of a Monetary Expert is to assist clients establish a strategy to meet the financial objectives.

It is crucial to recognize all fees and the structure in which the consultant runs. The Financial Expert is accountable for providing value for the charges. https://www.pearltrees.com/clarkwealthpt/item764599442.

Getting The Clark Wealth Partners To Work

You need it to understand where you're going, just how you're obtaining there, and what to do if there are bumps in the road. A good monetary expert can place with each other an extensive strategy to help you run your company much more effectively and prepare for abnormalities that arise - https://opencollective.com/clark-wealth-partners.

It's everything about making the best financial decisions to boost your chances of success. They can direct you towards the most effective possibilities to increase your profits. Minimized Stress and anxiety As a local business owner, you have great deals of points to bother with. An excellent financial advisor can bring you satisfaction recognizing that your finances are getting the attention they need and your money is being spent intelligently.

Third-Party Viewpoint You are completely bought your company. Your days are loaded with choices and problems that influence your firm. Occasionally local business owner are so concentrated on the day-to-day work that they shed sight of the big picture, which is to make a profit. A financial expert will certainly check out the general state of your funds without getting feelings entailed.

Clark Wealth Partners Things To Know Before You Buy

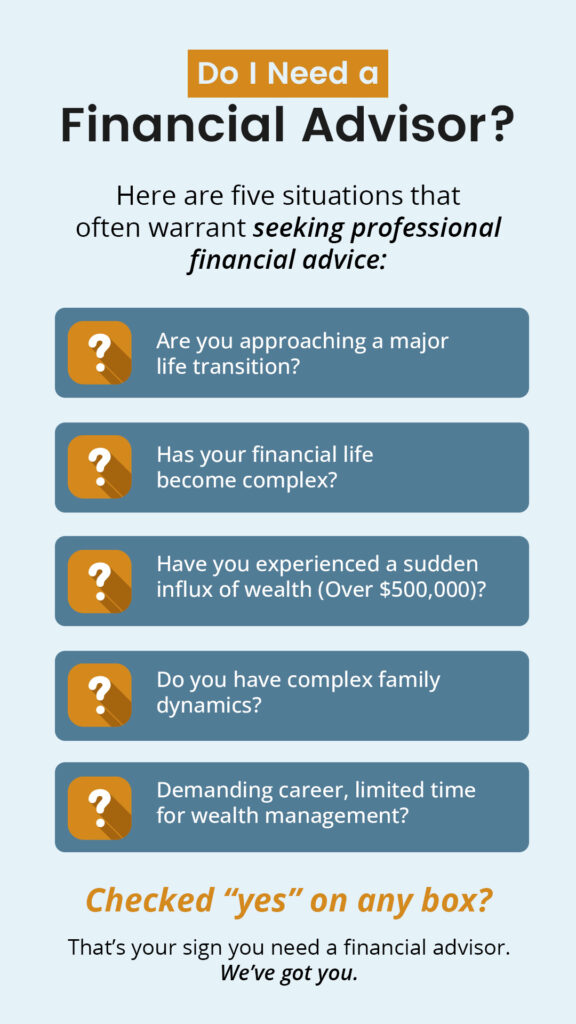

There are several pros and cons to think about when working with an economic consultant. Advisors deal personalized methods customized to specific goals, potentially leading to much better monetary end results.

The price of working with an economic consultant can be considerable, with fees that may influence general returns. Financial preparation can be frustrating. We advise talking with an economic advisor.

Discover Your Advisor Individuals turn to economic consultants for a myriad of reasons. The possible benefits of working with a consultant consist of the proficiency and knowledge they provide, the personalized suggestions they can give and the long-lasting discipline they can infuse.

3 Simple Techniques For Clark Wealth Partners

Advisors are skilled specialists who stay updated on market fads, financial investment techniques and economic regulations. This understanding allows them to give understandings that might not be easily obvious to the ordinary individual - https://businesslistingplus.com/profile/clarkwealthpt/. Their expertise can assist you navigate complicated economic situations, make educated decisions and potentially exceed what you would achieve on your own